The current state of ecommerce in manufacturing

After a year of uncertainty, manufacturers feel ambitious and are ready to invest. They want to boost their online revenue on an international scale. But what is the current state of international ecommerce in manufacturing?

The world of manufacturing is a very interesting one. The B2B industry has been watching for years how the B2C industry digitized and adapted its websites to the needs of the consumer. Now it’s time for the B2B sector to invest and boost their revenue by being present online, and in a way their customers are already used to.

Where do B2B ecommerce companies stand now?

By analyzing the current state of ecommerce in manufacturing and looking at where companies stand in terms of local effectiveness, product complexity, ecommerce platforms, and future investments, Copperberg and Intershop gathered some interesting insights that should help manufacturers get ready for the near future.

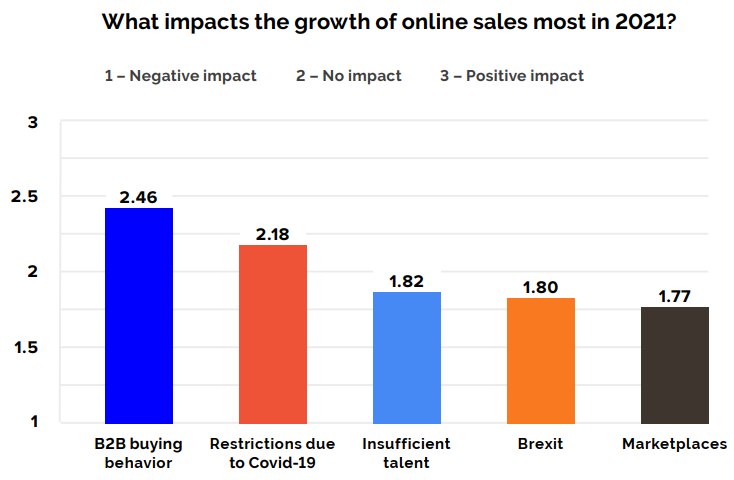

Covid-19 boosted ecommerce, but the changed buying behavior is a stronger growth driver.

According to the report “The State of International E-Commerce in Manufacturing“, Covid-19 has significantly boosted ecommerce activities among manufacturers. But an even stronger driver for growth seems to be the change in online buying behavior within the business-to-business industry.

B2B buyers have advanced online-first expectations

B2B buyers, similar to their B2C counterparts, have advanced online-first expectations. And even although more and more international sales interactions take place through online channels, customers are still doomed to navigate the complex B2B buying process. With almost two-thirds of all B2B purchasing decisions being made on digital channels, many manufacturers need to adapt to this and get their websites ready for B2B ecommerce.

According to the authors, not all merchants are used to sell online and thus compete effectively. The Covid-19 outbreak has led to more companies being forced to adapt, but this process of adaptation to ecommerce is still ongoing for many.

Managing sales separately will negatively impact buyer-seller interactions.

“There are prospective roadblocks that need to be addressed. The most telling example of a potential drawback is the existence of siloed sales- and service channels”, they write. “Managing digital, direct, and indirect sales separately will negatively impact buyer-seller interactions – and this works against the interests of today’s customers.”

Even before the pandemic, manufacturers were focused on the online transition. In a survey report from 2018, about 80 percent of B2B decision-makers said that if their organization doesn’t start with ecommerce now, they will be going out of business in five years’ time.

‘Most manufacturers are not ready yet’

But the authors point out: ” In reality, not much has changed since 2018, for our research in 2020 proved that most manufacturers are not willing or ready (yet!) to tap into the full potential of the digital after-sales business.”

The most recent report shows that 17 percent of professionals have yet to expand into ecommerce, while the majority already has a global ecommerce strategy in place, be it partially (35 percent) or entirely implemented (31 percent).

Technology investment priorities

Manufacturers are largely focused on investing in technology within the next twelve months, citing ecommerce solutions (67 percent), tools for back-end integrations (54 percent), digital marketing tools (51 percent), digital self-services (49 percent), AI/machine learning (44 percent) and customer portals (43 percent) as the way to achieving their online goals.

The report thinks quick and efficient buying journeys, such as provided by Amazon Business for example, have reshaped the expectations of B2B buyers. These examples have also shortened the distance between customers and suppliers. “But there’s a hurdle that keeps some organizations from optimizing today’s digitally-driven buyer journey: firms often find themselves under severe budget pressure – which may prompt investors to question whether to drive technology spending or not.”

Firms are often under severe budget pressure.

Almost half of respondents react to this by not just investing, but even to increase their budget for digital investments this year by 10 percent or more. And one in six industry players want to reach their online goals with a 1 to 9 percent increase in budget investments.

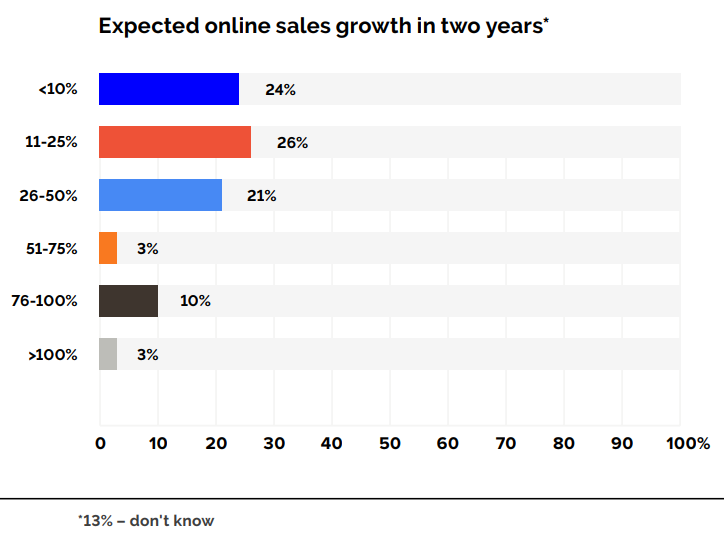

‘25% increase in online sales in next two years’

Many manufacturers predict a 25 percent increase in online sales in the next two years. And many industry players want to lead the path to innovation (instead of just following it). More than 60 percent have a strong ambition to take over ecommerce leadership in their respective markets.

Half of respondents generate less than 10% online.

The report shows that 10 percent of surveyed professionals generate over 90 percent of their global product revenue through online sales. A similar percentage generate more than 51 percent of their revenue by selling digitally. A significant 47 percent, however, see no more than 10 percent of their revenue result from ecommerce.

Challenges to achieve ecommerce ambitions

So, what are the challenging obstacles to realizing ecommerce ambitions? Popular answers to this question are the immaturity of customers (40 percent) and the lack of digital skills and knowledge (33 percent).

Central efficiency or local effectiveness?

And then there’s the choice between central efficiency and local effectiveness. Centralized ecommerce and decentralized ecommerce both have their pros and cons. But the data shows that the 39 percent of respondents that manage their global ecommerce activities using a central platform and marketing approach, reach up to 25 percent in online revenue.

However, the 36 percent that use a central platform combined with local marketing, alongside the 14 percent that use a local platform and marketing approach, reach between 25 and over 90 percent in online revenue. Still, centralized ecommerce is the most common approach, according to Copperberg and Intershop. “Stability is preferred amid global economic uncertainties – and so, many firms will presumably not withdraw from their mission to centralize commerce in the coming years.”

Modern platform should provide at least 80% of global requirements

The authors claim that a modern ecommerce platform should provide at least 80 percent of the global requirements. “In addition, there are the business processes that are specific to your company but are mapped in all national organizations. That’s about 15 percent. The remaining 5 percent is what makes each online shop special in each country – functions, user journey, or third-party applications.”

The web content needs to be in the local language.

They cite translations as a good example of this. “To successfully run ecommerce in a new country, the web content needs to be in the local language – this improves conversion and search engine ranking.”

Get more insights

The report “The State of International E-Commerce in Manufacturing“ is very extensive and also goes into great detail about the best practices for a local approach, the types of products sold online, how to sell complex products, the challenges of homegrown ecommerce solutions, and much more. Download the report for free to get all these insights.

Comments