The ecommerce situation in Switzerland in 2015

The online trade in goods in Switzerland grew by around 10% year-on-year in 2014, with foreign suppliers increasing their market share. While Swiss online retailers expect, partly due to mobile traffic, to grow their business further in the upcoming years, they still have to tackle falling prices and increasingly fierce competition from foreign players and omnichannel retailers.

The Swiss payment provider Datatrans tries to map the current ecommerce industry in Switzerland for seven years now. The latest edition involves 38 ecommerce players that are headquartered in the Central European country. In its report “E-Commerce-Report Switzerland 2015” Datatrans found out that two out of five respondents expects the online share in their industry to increase by 50% or more over the next five years. The weak euro however, has intensified the competitive situation for Swiss ecommerce players even further.

And then there are the foreign players that are increasing their market share in Switzerland. But by investing in an even more attractive offer, online shops that are adapted to mobile devices, and internal efficiencies, the Swiss online retailers are holding strong.

The impact of the euro

According to the PSP, the dramatic devaluation of the euro in January had its impact on online retailers in Switzerland. To counteract the fact consumers are buying more abroad, many retailers lowered their prices spontaneously and thus had to take losses into account, since they bought the goods at old prices. And the prices are durably lower in the foreseeable future, which will lead to lower sales at the same sales volume.

Meanwhile, the Swiss market gets even more attractive for foreign suppliers. In many sectors a further shift of purchasing power to outlandish retailers is expected. “The weak euro is forcing Swiss retailers to be even more efficient”, says study author Ralf Wölfle. “The big online retailers will be even bigger because of this.”

Increasing market share for foreign players

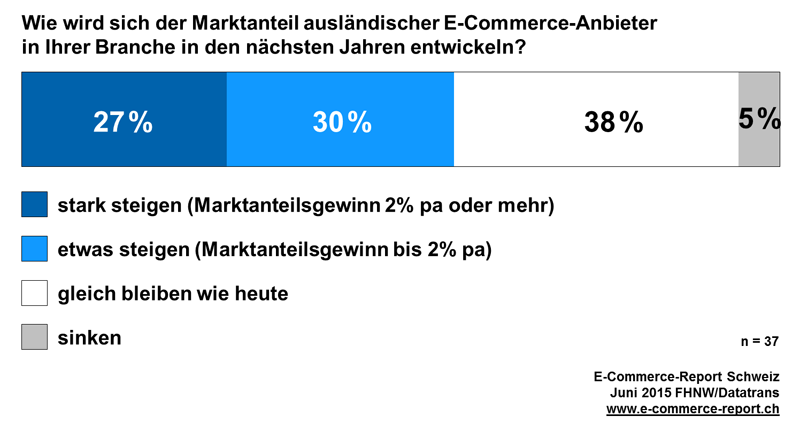

Datatrans asked 37 companies how they think the market share of foreign ecommerce players in their industry will develop in the coming years. More than one in four companies (27%) think these foreign players will increase their market share by 2% or more, while 30% thinks their share will rise slightly (up to 2%).

The respondents think the increasing use of internet on mobile devices will be the number one growth driver for ecommerce in Switzerland. At the same time, lots of websites still aren’t optimized for mobile devices, especially in the check-out process.

The fashion industry is the only sector in the Swiss ecommerce where the trend of disintermediation, also known as cutting out the middlemen, is noticeable. This trend is carried out online as well in physical stores. But at the same time popular fashion brands reject against trading partners who do not sell their products solely in store, but also online. “The restrictive attitude of fashion brands towards the online distribution of its trading partners is undermining their plans to implement a multi-channel strategy”, says Wölfle.

Retailers need to invest

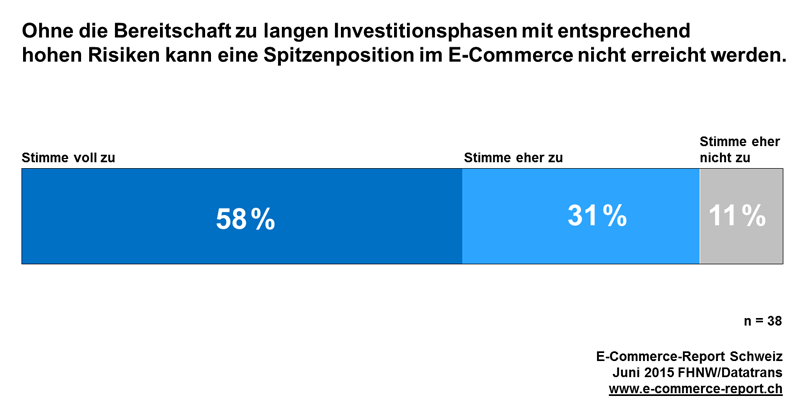

In order to survive in the competitive market, online retailers continue to invest heavily. A majority of respondents say they want to invest more than they did in previous years. The companies involved responded to the statement “without the willingness to invest for longer period with correspondingly high risk, a leading position in ecommerce can’t be achieved” Almost six in ten (58%) fully agrees, while 31% somewhat agrees with this.

Comments