Wanted in Europe: prime warehouses

There’s a big demand for so called prime warehouses in Europe, and the scarcity of it is affecting both occupier and investment markets in Europe. It has led to bidding wars at a European scale, which will push yields down, a new study shows.

BNP Paribas Real Estated presented its latest European Logistics Market report [pdf] during Expo Real 2015, which took place from October 5 to 7 in Munich. One of the findings is that economic uncertainties still impact on speculative developments. “This leaves the development pipeline insufficient to offset the structural lack of new supply after several years of crisis.”

Despite the supply issues, the occupiers market is increasing in Europe. Take-up, the space that’s physically occupied, increased by 21 percent in the 22 European cities covered by the research during the period H1 2014 to H1 2015. But because there is a lack of prime supply, it’s still affecting the market. During the second quarter of this year, high grade supply stood at its lowest level. A popular alternative, especially for large units, are design and build solutions.

Low margins in logistics industry

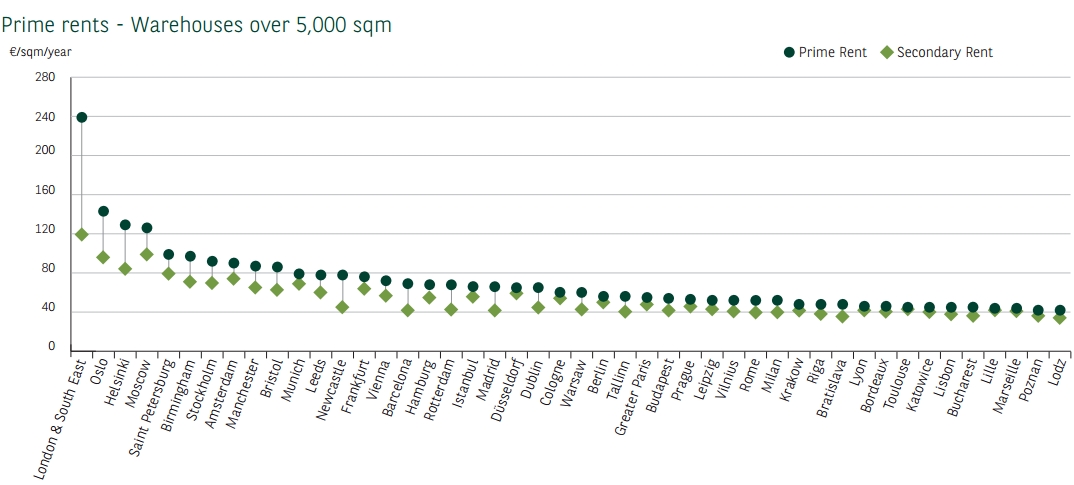

The study shows that despite the chronic lack of prime new warehouses (“those of the highest quality and specification and in the best location in a market”), the prime rents only evolved marginally in the most important European markets. “One of the main reasons lies in the low margins achieved in the logistics industry, which in turn constrain tenants who can’t afford higher rents”, says Logan Smith, head of logistics at BNP Paribas.

More than half comes from ecommerce

As ecommerce activity keeps on growing in Europe, the demand for warehouses from the retail and distribution sector accounted for more than half of the total volume of transactions signed over the past twelve months. In France, this share was 61 percent, while in the United Kingdom it account for 57 percent of all deals made. In the Netherlands it’s 52 percent, while in Germany it represented ‘just’ 25 percent. There it was surpassed by the industrial sector, which is a traditionally strong demand source.

During the first half of this year, 75 percent of total logistics and industrial investment in Europe came from four countries: the United Kingdom, Germany, Sweden and France. The total investment for sector was worth 10.1 billion euros during this period. The United Kingdom accounted for some 45 percent of all industrial and logistics investments in Europe, with 4.3 billion euros achieved during the first half of this year. Although the demand remained strong, the volume of investment declined by 28 percent compared to the same period last year. “There’s still a lack of opportunities and when they arise, they result in bidding wars, which affects yields.”

Due to a stronger demand and a limited prime availability, prime yields are nearing their lowest point in most European countries, the study suggests. “They dropped well below 5 percent in the UK and in the main German hubs. They reached 6.20 percent in Amsterdam, 6.25 percent in Stockholm and 6.35 percent in Paris, whilst they bottomed out to 6.75 percent in Ireland and the Czech Republic.”

Comments