Asendia publishes white paper on Germany

Asendia has written a very thorough white paper on the ecommerce industry of Germany. The international mail joint venture of French La Poste and Swiss Post shares the know-how it has gathered to help online retailers on their way to what they call “the heart of Europe”.

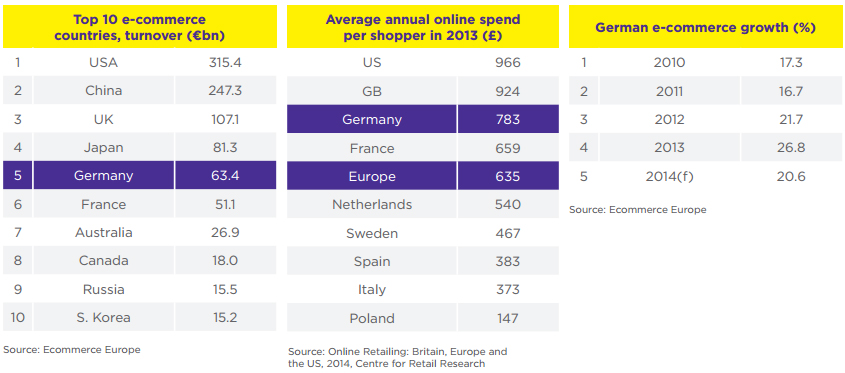

It seems pretty obvious why Asendia has focused its white paper on Germany. Because with a population of 82 million, it’s Europe’s largest consumer market. And annual online shopping revenues reached more than 40 billion a year, and this number is predicted to reach 100 billion euros within five years. “But with spend per household still relatively low, there’s plenty of room for growth”, says the logistics company.

The German economy grew 2% in 2013 and inflation is minimal. But not all things go well, as consumer confidence started falling in the second half of last year. “But it’s still at a similar level to that seen before the financial crisis in 2007/8 and better than many other markets.”

The average German consumer

When we zoom in on the German population, we’ll see that Germans nominally had €586 more purchase power per capita at their disposal in 2014 than they had in 2013, equating to €21,179 per person. The average German consumer tends to be more conservative, likes to be in control and is less ostentatious than consumers elsewhere in Europe, a report of Kantar Media suggests.

Reasons to enter German ecommerce market

In its white paper, Asendia gives nine reasons to enter the German market. It’s Europe’s largest consumer market, it’s posting the fastest ecommerce growth among mature markets, it has a first-class logistics network, consumers are online savvy and have similar consumer needs, there’s a high purchasing power among these consumers, there are no import barriers for EU member states, there’s a common currency for those in the Eurozone (as well as currency as price stability) and there is a good payment culture in Germany.

Ecommerce: 9.4% of total retail revenues

In the white paper Asendia say that although the German retail sector consists of about 400,000 companies and 3 million employees, ecommerce is only expected to account for 9.4% of total retail revenues in 2014. “So it’s important for foreign players to understand the rest of the market – and the competition they’ll be up against.”

Competition is enormously high

According to Euromonitor the level of competition and fragmentation in the German market is “enormously high”. And a study by retail association Handelsverband Deutschland suggests the German retail industry is on track to record 1.5% growth in 2014. “But this is mainly driven by ecommerce – and the association predicts that the structural shift that’s underway in the market could see 50,000 physical retail locations disappear by 2020.”

The white paper contains much more info. You can read more about consumer behavior in Germany, read everything about the local retail industry or how the top three ecommerce players in Germany (Amazon, Otto and Zalando) have each taken a different route to success. The pdf also contains handy information about the most important payment methods, cross-border sales, social media usage and much more.

Download free Germany white paper

You can download the white paper on Germany for free using this link.

Comments