Ecommerce in Europe

![]() The ecommerce industry in Europe consists of three major markets, upcoming countries and thriving startup scenes. Because the European industry consists of several regions that all play their own role, it can be difficult to see it as one. Let’s have a look at ecommerce in Europe.

The ecommerce industry in Europe consists of three major markets, upcoming countries and thriving startup scenes. Because the European industry consists of several regions that all play their own role, it can be difficult to see it as one. Let’s have a look at ecommerce in Europe.

|

STATISTICS

|

EUROPE

|

|---|---|

| Population | 746.4 million people |

| Internet users (% of population) | 87% |

| Online sales | €899 billion (2022) |

| Online stores worth mentioning: | Otto, Tesco, CDiscount, Bol.com, Zalando, H&M |

Content:

- Ecommerce customers in Europe

- Ecommerce per country

- Payment methods

- The ecommerce market in Europe

- Big online stores in Europe

- Latest ecommerce news from or about Europe

Ecommerce customers in Europe

According to research from Direct Link, at least 297 million European consumers shopped online in 2020. They estimated to have spent 465 billion euros online. Additionally, European consumers often shop cross-border. Up to 216 million European consumers made online purchases from abroad. You can read more about online consumer behavior in Europe on our dedicated page.

Looking for ecommerce software to start selling in Europe? Webador and Shopify are platforms that are well optimized for cross-border ecommerce.

Ecommerce per country

- Austria

- Belgium

- Bulgaria

- Croatia

- The Czech Republic

- Denmark

- Finland

- France

- Germany

- Greece

- Hungary

- Italy

- Luxembourg

- The Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- The United Kingdom

Ecommerce per region

Payment methods

Cards account for the largest share of business-to-consumer ecommerce transactions in Europe, as research from yStats.com shows. Digital wallets are second best. In the UK, credit cards are very popular: about four in ten online transactions are paid this way. Debit cards account for 35 percent of all online transactions, while PayPal is the country’s third most used online payment method. Germans like to pay with invoice, while French consumers use debit card Carte-Blue, MasterCard, American Express and PayPal. In the Benelux, iDeal (the Netherlands) and Bancontact (Belgium) are very popular. For more common payment methods in Europe, check out our overview of the most popular online payment methods in Europe.

Do you want to sell cross-border in Europe? It ain't easy but with the right ecommerce software, online marketing channels and European fulfillment companies market leadership is surely possible.

The ecommerce market in Europe

Data from 2020 shows that in the UK, Germany, France, Spain and Italy clothing and footwear are amongst the most popular product categories, just like home electronics and books. In the Nordics, cosmetics and skin care is also one of the most popular product categories.

Ecommerce sales in Europe are expected to be worth 1.4 trillion euros by 2027.

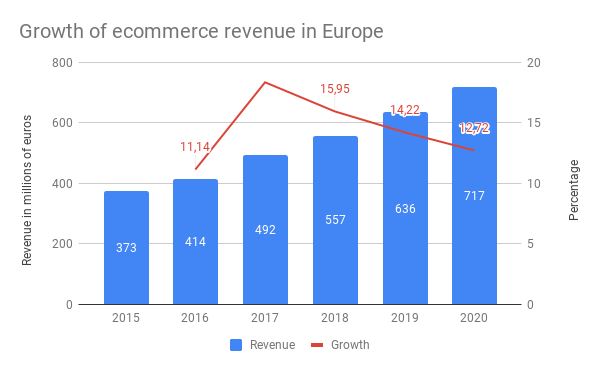

Ecommerce sales in Europe were worth 899 billion euros in 2022. It is expected that online sales in Europe will reach 1.4 trillion euros by 2027. Most of the online turnover is still being generated in Western Europe, which accounts for approximately 70 percent of total European online retail turnover. Southern Europe, Northern Europe, Central Europe and Eastern Europe show a much lower share of European ecommerce with 15, 7, 6, and 1 percent respectively.

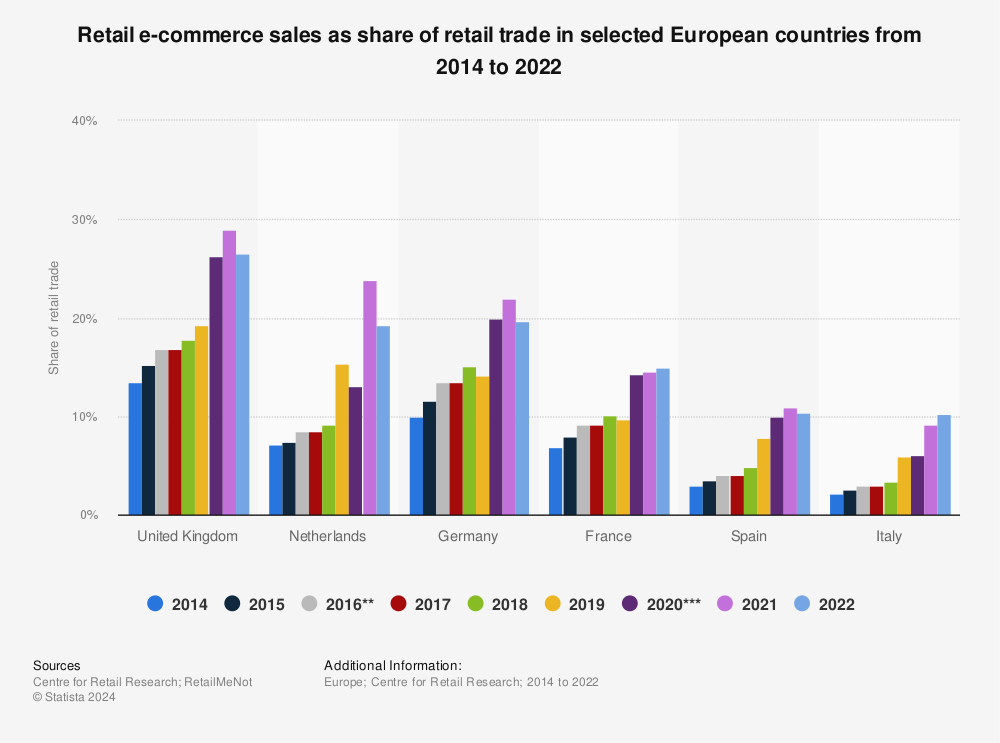

According to research by Direct Link, Germany and the UK are the strongest ecommerce markets in Europe. They have relatively high purchase amounts and a high ecommerce share combined with a large population. Data from Statista shows that ecommerce sales in the UK reached 28,9 percent of the total retail sale in 2021. In the Netherlands, online sales amounted to 23,9 percent of total retail trade. It is followed by Germany (21,9 percent) and France (14,6 percent).

Big online stores in Europe

Of course, major American retailers have their influence on local ecommerce industries in Europe. As a matter of fact, Amazon was the most-visited online marketplace in Europe in 2018. But that’s not to say Europe doesn’t have its own ‘Amazons’. In Internet Retailer’s top 10 list of biggest online retailers in Europe, Amazon, Staples and Apple are the only American retailers. The list also contains Otto (Germany), Tesco (UK), Groupe Casino (France), Shop Direct Group, Home Retail Group (both UK), Zalando (Germany) and John Lewis (UK). And then there’s this list of top 10 online stores in Europe, which features Amazon (on 7th place) as the only non-European player in that list.

Latest news about Europe

Read all our articles about ecommerce in Europe.

Last update: August 2022