Ecommerce in Germany

Germany is one of Europe’s largest economies, with a population of 83 million people and a high living standard. Its wide internet coverage – 95 percent of the German population has access to a 5G connection – also makes it one of Europe’s strongest ecommerce markets.

Content:

- The ecommerce market

- Laws and regulations in German ecommerce

- Big online stores

- Ecommerce events in Germany

- News from or about Germany

| COUNTRY | GERMANY |  |

| Population | 83.9 million people | |

| – % internet users | 95 % | |

| Online sales | €79.7 billion (2023) | |

| Large stores: | Otto, Zalando, Mediamarkt |

Looking for ecommerce software to start selling in Europe? Webador and Shopify are platforms that are well optimized for cross-border ecommerce.

Ecommerce customers in Germany

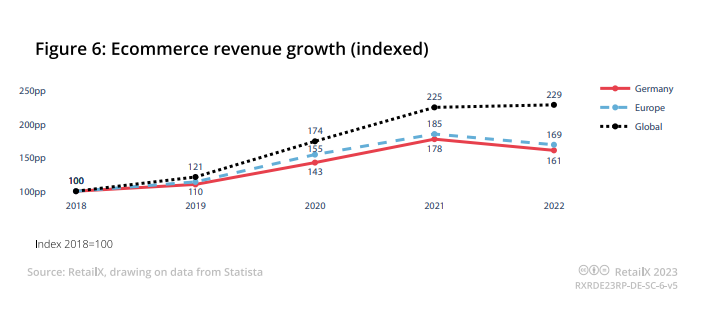

Germany has lagged behind the rest of Europe in the adoption of online shopping, but has closed that gap in recent years. At least 80 percent of Germans are now buying products online. In 2023, German online sales amounted to 79.7 billion euros.

GENERAL PROFILE – German customers have some characteristics that are important to consider when entering the German market. They are very loyal to brands that have proven worthy of their trust – but they are also hard to win over. The first time they visit your online store, they will scrutinize it thoroughly. Here are a few general tips:

- Make sure your website is in German, and localized. Hire a native speaker to translate and adapt your content, and make sure it is spotless.

- Germans like to be addressed in a formal manner.

- Germans read everything and expect your site to be without errors. Make sure you clearly state your Terms & Conditions for payment and delivery, and comply with the legal requirement of an Impressum and a Privacy Policy. If you do not, legal firms will find your site and sue you, since legal enforcement is strict.

- Make sure to have a trustmark on your site.

- Show reviews from other customers. Supply social proof from German customers.

- Provide excellent service, such as swift delivery and a German-speaking customer service. German customers are used to it and will expect it.

- Germans are concerned about privacy and are reluctant to hand over their data. Give them the option to shop with a guest account, and to pay with an e-wallet.

- First-time German shoppers will appreciate post-pay billing services like Klarna and Afterpay.

German consumers like to be informed. Almost half of them research the internet before buying. They consult customer reviews, for example. Social commerce influences German consumers to purchase, too. With more than a third of German consumers shopping via social media, the importance of those channels is growing. The most popular platform is Instagram, followed by Facebook. Advertising is another good way to get the attention of the German customer. Hire a German marketing agency and consider investing in primetime television ads.

PREFERRED SHOPS – Germans prefer shopping on marketplaces such as Amazon.de and OTTO to buying from branded ecommerce stores. In general, they trust German brands more than foreign brands.

PREFERRED PAYMENT METHODS – Traditionally, online shoppers in Germany are keen on using invoice. This was their preferred online payment method for years, but since 2021 its market share has decreased. In 2023, PayPal was the most popular payment method in the country. Of all German online purchases, 27.7 percent was paid for by using PayPal.

Buying on account had a market share of 26.7 percent in that year. Other popular payment methods are e-wallets such as Google Pay, Apple Pay and Amazon Pay. Credit card and direct debit are other popular payment methods.

The German ecommerce market

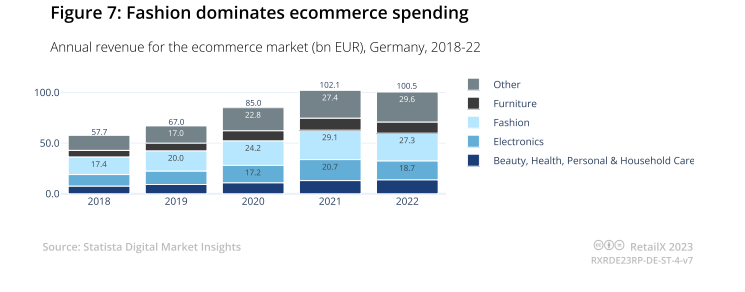

PRODUCT CATEGORIES – Online fashion is the most popular product category in Germany, followed by consumer media and electronics. Fashion dominates spending in the German market, with 27.3 billion euros of revenue for the ecommerce market coming from fashion in 2022.

With 18.7 billion euros of sales, electronics is the next strongest sector in 2022. Growth has slowed in all sectors in 2022, most likely because spending has been impacted by the cost-of-living crisis, but has shown an upward trend again in 2023.

Especially in the categories ‘consumer electronics & computers’ and ‘media’ (books, music, movies, video games) German consumers are keener on shopping online instead of shopping offline. According to a study from RetailX, 85 percent of German citizens shopped online during 2020. And 95 percent of the population had an internet connection that year.

FREQUENCY AND AVERAGE ORDER VALUE – About one in ten consumers shop online at least once a day. Around one in four shop online more than once a week and 42 percent shop online more than once a month. Four in ten shoppers spend between 12 and 120 euros a month. Nearly a third spend between 121 and 290 euros a month. And 16 percent say they spend between 291 and 590 euros a month.

DELIVERY – Germany’s ecommerce logistics network is highly efficient, with shipping giants such as DHL, Hermes, DPD, GLS and UPS being the largest players. Average packet transit time is 1.5 days, and a first-attempt success record of 94.8 percent sets the standard for deliveries. Around 7 percent of packages are delivered to pickup points. More than half of these are picked up within 24 hours.

RETURNS – Germany is known for its high return percentage. A report in 2024 showed that Germans return 11 percent of all their online orders. Online retailers pay between 5 and 10 euros on average for a return. This makes avoiding returns a top priority for them. This is important to know if you want to do business in Germany.

DACH REGION – When entering the German market, ecommerce stores have the opportunity to access the whole of the DACH region as well. In 2022, the region had a combined population of 101.56 million people. These German-speaking countries do have their individual characteristics, however. Consider localizing your store for the various regions within DACH.

Laws and regulations in German ecommerce

LEGAL CONTENT – Online stores operating in Germany are required to have certain legal content on their site. Make sure you clearly state your Terms & Conditions for payment and delivery, and comply with the legal requirement of an Impressum and a Privacy Policy. If you do not, legal firms will find your site and sue you, since legal enforcement is strict.

PACKAGING LAW – Online stores in Germany are required to pay fees over packing material. Organizations like Der Gruner Punkt can take care of this for ecommerce stores.

VAT – Online retailers selling in Germany have to comply with German and European VAT regulations. When storing your inventory on German soil, you will need to register for a VAT number, for instance. Under European law, depending on your total amount of sales abroad, your VAT registration changes. Make sure you do your research before entering the German market, or collaborate with partners who are already doing business in Germany.

Big online stores in Germany

Ecommerce in Germany seems all about two big players: American retailer Amazon and German-founded Otto. They own almost half of the online market, so it is pretty clear that it is quite hard for smaller merchants to make a difference.

The current top 10 online stores in Germany is: Amazon (14.4 billion euros), Otto (4.5 billion euros), Zalando (2.6 billion euros), MediaMarkt (1.8 billion euros), Apple (1.4 billion euros), Ikea (1.3 billion euros), Lidl (966 million euros), H&M (900.2 million euros), Saturn (897 million euros), and About You (895 million euros).

Ecommerce events in Germany

A number of ecommerce events take place in Germany each year, the most important one being the E-commerce Berlin Expo. Check out our ecommerce events calendar for all the major online retail events in Europe.

Latest news about Germany

Read all our articles about ecommerce in Germany.