Online payment trends across Europe

When it comes to paying for online purchases, many shoppers use their credit cards, PayPal or bank transfers. But which payment methods are most popular? And what’s the difference in payment preferences among different countries across Europe?

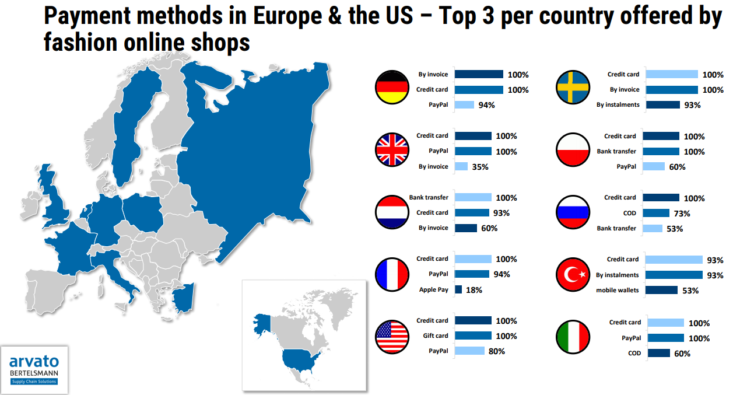

Aravato took a closer look at payment systems in online shops. It studied the payment trends in the United Kingdom, Germany, France, the Netherlands, Italy, Sweden, Poland, Russia, Turkey, and the US.

Payment methods in Russia

One of the findings is that in Russia, payment by credit card is the most preferred method. Russians not only use the well-known cards from Visa and Mastercard, but also from domestic credit/debit card system MIR.

Payment on delivery is another very popular method. “What sounds unusual for us is completely normal for Russians”, Dennis Schmitz, Vice President Financial Services at Arvato Supply Chain Solutions, says. Some shops even use their own courier personnel: the drivers are instructed to wait for 15 minutes while the customer tries on the ordered goods and determines if they wish to keep them and make payments or return them immediately. Often this is because of the cumbersome nature of the returns process.”

Russians like to pay on delivery.

Online retailers looking to expand to Russia, should carefully think about the payment methods they will offer in their checkouts. Russia shows the highest growth rate for mobile payments in Europe (of the countries examined by Arvato), but Russians clearly prefer national systems such as Yandex Money, QIWI and WebMoney over global competitors like PayPal.

Payment methods in Turkey

In Turkey, credit card are also the most popular payment method, with Visa and Mastercard each having 93 percent coverage. But 40 percent of the online shops studies offer the domestic credit card Troy, so it might be smart for foreign cross-border ecommerce companies to offer this card as well when selling in Turkey.

Arvato found it interesting that in Turkey there are many national banks that offer their own credit card systems with repayment in installments. It’s estimated that 55 percent of all card transactions are made up by this method.

And similar to Russia, mobile payments are rising in Turkey too. National providers like BKM Express, GarantiPay, and Masterpass are in the lead here.

Mobile payment methods in Turkey are on the rise.

Payment methods in Poland

In Poland, it seems that the preferred payment method is bank transfer. One in two customers would choose this method to complete their online order. In Polish ecommerce, PayU is a very popular method, as well as Dotpay and Przelewy24. “Cash on delivery, still quite popular in Poland and offered by 60% of online shops analyzed, will lose ground to mobile payment solutions”, Schmitz says.

In Poland, there’s BLIK, which is supported by all major Polish banks as a national alternative to Apple Pay and Google Pay. This system is becoming increasingly popular, Arvato claims. Last year, 8 million users were responsible for 218 million transactions using BLIK, and this number is rising.

BLIK is supported by Polish banks to compete with Apple Pay and Google Pay.

Payment methods in Sweden

In Sweden, the credit card is popular, but so is purchasing on account, which means consumers look first, then buy. Over half of the online shops examined that offer payment on account do so via the very popular Swedish fintech Klarna.

Comments