Ecommerce fulfillment per country

Last year, a lot happened in the world of logistics and ecommerce fulfillment. The coronavirus pandemic has boosted ecommerce in many ways, but also led to many companies having to make significant changes in the short term. What’s the state of ecommerce fulfillment per country in 2021?

The unexpected, and unprecedented, growth of ecommerce in Europe last year came with some challenges, especially in the fulfillment area. All across the continent, fulfillment centers and suppliers worked non-stop at full capacity to process all these online orders. And on top of that, there were also the increased number of returns and the challenges created by Brexit.

But what’s the current situation of fulfillment per country and industry? Salesupply just released a whitepaper, called “State of Ecommerce Fulfillment 2021“, in which it provides insight into the situation.

Ecommerce fulfillment in the Netherlands

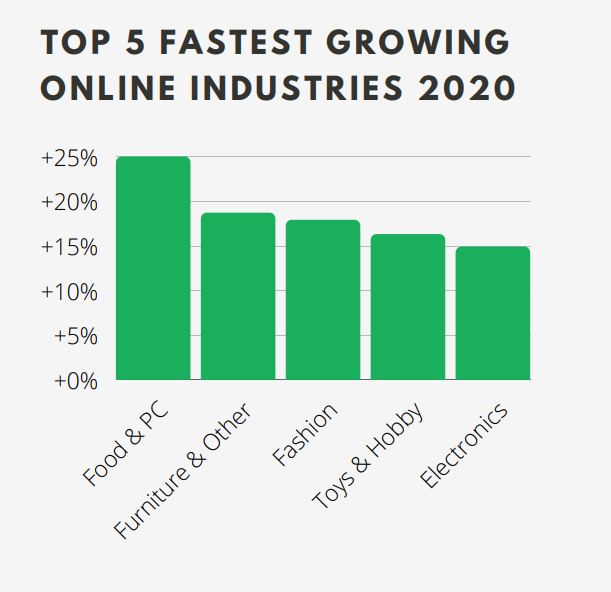

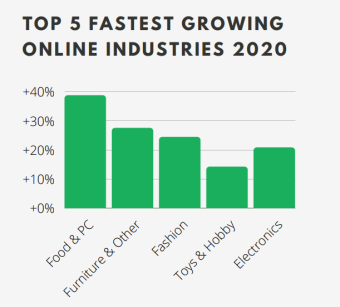

The pandemic has had a strong impact on ecommerce in the Netherlands. In the first half of last year, online spending increased by 4 percent, while the number of online orders grew 22 percent. Food & personal care was the fastest growing online industry in the Netherlands last year, followed by furniture, and fashion.

The pandemic has had a strong impact on ecommerce in the Netherlands. In the first half of last year, online spending increased by 4 percent, while the number of online orders grew 22 percent. Food & personal care was the fastest growing online industry in the Netherlands last year, followed by furniture, and fashion.

For Dutch consumers, high shipping costs are an important reason to abandon their shopping carts. But a longer delivery time and the lack of choice in delivery options also have a major impact on the online store’s conversion rate.

The Dutch return online orders the most.

In the Netherlands, the average delivery time is 2 to 3 working days, although a maximum of 3 to 5 is also accepted. Over half of consumers opt more frequently for an online store where they can specify the desired delivery time themselves. And when it comes to returns, the Dutch return more than consumers in the other countries covered in the whitepaper.

Ecommerce fulfillment in Belgium

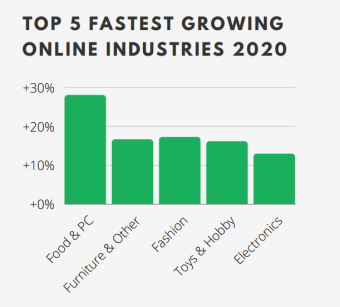

In Belgium, there were more than 7.5 million ecommerce consumers in 2010. And six in ten do some online research first before they decide to make an online purchase. Belgian consumers search mostly for electronics and household appliances online, although the largest growth in ecommerce was, unsurprisingly, seen in the food & personal care category.

In Belgium, there were more than 7.5 million ecommerce consumers in 2010. And six in ten do some online research first before they decide to make an online purchase. Belgian consumers search mostly for electronics and household appliances online, although the largest growth in ecommerce was, unsurprisingly, seen in the food & personal care category.

When compared to the other countries in the newspaper, Belgium seems to have quite a large share of cross-border sales, namely 30.8 percent. The Netherlands are a popular shopping destination, with local household names such as Bol.com and Coolblue being very present in Belgium as well.

Belgium has a large share of cross-border sales.

When they order online, Belgian shoppers like to receive their products delivered at their homes during the day. Click & Collect, which is for example very popular in France, isn’t very in demand among Belgians. Only 2 percent prefer this delivery method.

Ecommerce fulfillment in Germany

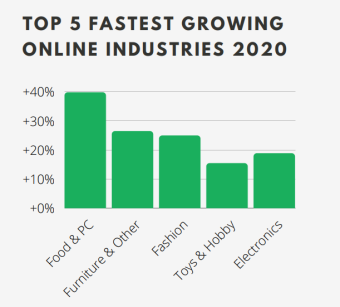

Germany has one of the largest ecommerce markets in Europe. Currently it counts over 62.4 million online consumers and this number is predicted to increase to 69.2 million by 2024. Ecommerce in Germany increased by 18.6 percent last year.

Germany has one of the largest ecommerce markets in Europe. Currently it counts over 62.4 million online consumers and this number is predicted to increase to 69.2 million by 2024. Ecommerce in Germany increased by 18.6 percent last year.

According to the whitepaper, over half of Germans don’t return any of their online purchases. And if they do return items, it’s mostly clothing, followed by shoes and consumer electronics. Hobby articles are returned the least.

Half of Germans don’t return their online purchases.

When making online purchases, more than one in three consumers in Germany think fast delivery and the option to choose the delivery address are very important.

Ecommerce fulfillment in France

France currently has 46 million ecommerce customers, making this country one of the largest online retail markets in Europe. And this number of online shoppers is set to increase by another 11 percent to 51 million users by 2024.

France currently has 46 million ecommerce customers, making this country one of the largest online retail markets in Europe. And this number of online shoppers is set to increase by another 11 percent to 51 million users by 2024.

Due to the corona virus outbreak, the interest of French consumers has shifted. It went from spending money online on tourism and media to buying items from supermarkets and ordering sports goods. The category with food and personal care has shown the biggest growth, a trend that’s similar in most European countries.

63% of French don’t return online purchases.

When it comes to returning online orders, the French mostly return clothing (18 percent) and shoes (12 percent). But surprisingly, over 63 percent of consumers claim they don’t return any online purchases.

The cross-border share in France is relatively low, at just 6.8 percent. But this percentage has increased (although slightly, by just 0.1 percent) last year.

When it’s about time to decide where the online purchase should go to, 85 percent of consumers in France choose home delivery, as this is (currently) the most practical solution for many people. But in addition to the ‘pick-up & go’ option, an increasing numbers of consumers are also tempted to opt for click & collect in-store. This is mostly because of the lower delivery costs.

Ecommerce fulfillment in the United Kingdom

In the United Kingdom, there are more than 57 million online shoppers. This number is expected to increase by 7 percent to 61 million ecommerce users in 2024. For Brits, the most popular reasons to shop online are immediate home delivery and lower prices. Some consumers also like to shop online because the product range is larger than in physical stores.

In the United Kingdom, there are more than 57 million online shoppers. This number is expected to increase by 7 percent to 61 million ecommerce users in 2024. For Brits, the most popular reasons to shop online are immediate home delivery and lower prices. Some consumers also like to shop online because the product range is larger than in physical stores.

Although 56 percent of consumers state they haven’t returned any online order. The ones who do, mostly return clothing and shoes they bought online. And when they buy these products and other items online, they mostly do this at British shops. The cross-border sales share in the UK is at just 4.1 percent.

Brexit doesn’t help with cross-border ecommerce.

Salesupply argues that Brexit certainly doesn’t help in this respect. “Delays at customs, carriers discontinuing their services between the EU and the UK, consumers who first have to pay VAT before they can receive their parcel: cross-border ecommerce in the UK is currently anything but being promoted.”

Ecommerce fulfillment in Spain

Although the fashion industry accounts for the largest product category in Spanish ecommerce, its the food branch that has grown the most last year. This has, of course, everything to do with the coronavirus outbreak. In Spain, 43 percent of online shoppers say they would like to return items they have ordered online. And when they do, it’s mostly clothing and shows. With just 6.3 percent, the cross-border sales share isn’t very high in Spain.

Although the fashion industry accounts for the largest product category in Spanish ecommerce, its the food branch that has grown the most last year. This has, of course, everything to do with the coronavirus outbreak. In Spain, 43 percent of online shoppers say they would like to return items they have ordered online. And when they do, it’s mostly clothing and shows. With just 6.3 percent, the cross-border sales share isn’t very high in Spain.

Salesupply likes to point out that the preferred payment methods in Spain have changed. Cash on delivery was a popular way to pay for products bought online, but this trend has shifted to payments with debit/credit cards or through online solutions like PayPal and Amazon Pay.

The preferred payment methods in Spain changed.

A lot has changed in the world of logistics and fulfillment due to Covid-19, leading to orders sometimes taking longer to be delivered than planned. Still, most ecommerce users in Spain expect their online order to be delivered within 2 to 3 days.

Ecommerce fulfillment in Italy

Last year, there were over 33 million online shoppers in Italy. Of this group, three-quarters do online research before they make a purchase. And just like in other European countries, the coronavirus outbreak has led to a shift from tourism to supermarkets. The online food and personal care industry has therefore seen the highest growth rate, compared to the situation in 2019.

Last year, there were over 33 million online shoppers in Italy. Of this group, three-quarters do online research before they make a purchase. And just like in other European countries, the coronavirus outbreak has led to a shift from tourism to supermarkets. The online food and personal care industry has therefore seen the highest growth rate, compared to the situation in 2019.

Just like in Spain, the preference among shoppers when it comes to paying for goods has changed. Once, cash on delivery was popular in Italy, but now it hardly plays a significant role anymore. Currently, consumers in Italy prefer to pay via PayPal or credit card.

66% of Italians don’t return items bought online.

Online shoppers in Italy don’t seem to be so keen on returns, as a whopping 66 percent claim they don’t return items they ordered online. But in the rare situation they do return, it’s mostly clothing, shoes and consumer electronics that are sent back to the online retailer.

The cross-border sales percentage in Italy was at 7.7 percent last year. That’s higher than the European Union average.

Ecommerce fulfillment in Poland

About 53 percent of Polish people shop online at least sometimes. And when they do, they are mostly interested in ordering shoes, clothing, and food. It’s no surprise the fashion industry is the largest online segment in Poland.

About 53 percent of Polish people shop online at least sometimes. And when they do, they are mostly interested in ordering shoes, clothing, and food. It’s no surprise the fashion industry is the largest online segment in Poland.

Online shoppers in Poland prefer to have their orders delivered to a parcel machine (Paczkomat, locker or SwipeBox) or directly to their homes. Click & collect is also a popular delivery method in Poland.

Delivery to a parcel machine is popular in Poland.

When they need to pay for the products they buy online, Polish consumers like to pay on delivery. Last year, at least 42 percent of Polish consumers made a payment using this method. Many consumers also pay with PayPal or Amazon Pay.

Two in three Polish users claim they don’t return any of the items they bought online. Among the most frequently returned items are clothing and shoes.

State of Ecommerce Fulfillment 2021

You can download Salesupply’s whitepaper “State of Ecommerce Fulfillment 2021” on their website for free. In this document, you will not only find insights into the situation per country, but also per industry. For example, prior to 2020, the majority of b2b consumers were made up of baby boomers and generation X. Nowadays, over 73 percent of business consumers are millennials.

Comments