Ecommerce in Europe

The ecommerce industry in Europe consists of three major markets, upcoming countries and thriving startup scenes. Because the European industry consists of several regions that all play their own role, it can be difficult to see it as one. Let’s have a look at ecommerce in Europe.

|

STATISTICS

|

EUROPE

|

|---|---|

| Population | 746.4 million people |

| Internet users (% of population) | 91% |

| Online sales | €741 billion (2023) |

| Online stores worth mentioning: | Otto, Tesco, CDiscount, Bol.com, Zalando, H&M |

Content:

- Ecommerce customers in Europe

- Ecommerce per country

- Payment methods

- The ecommerce market in Europe

- Big online stores in Europe

- Latest ecommerce news from or about Europe

Ecommerce customers in Europe

According to Eurostat, 70 percent of consumers in Europe bought or ordered services and goods online in 2023. The internet access of people in Europe is pretty high, with 91 percent of the population using internet in 2023.

In that same year, the online B2C market reached a turnover of 741 billion euros. Additionally, European consumers often shop cross-border. The European cross-border ecommerce market was worth 237 billion euros in 2023. You can read more about online consumer behavior in Europe on our dedicated page.

Looking for ecommerce software to start selling in Europe? Webador and Shopify are platforms that are well optimized for cross-border ecommerce.

Ecommerce per country

Payment methods

New online payment methods are increasingly replacing credit and debit card payments online in Europe. Think of PayPal for example. Since 2022, this is the most popular online payment method in Germany. Digital wallets, such as Apple Pay, are also increasingly popular.

There are also many local online payment methods, which are often the most popular in that country. In the Netherlands, local player iDeal is the most popular. And in Belgium, the most popular payment method is Bancontact.

‘Buy now, pay later’ services, such as Klarna, are also increasingly becoming popular. In Spain, for example, one in three consumers prefers paying in installments. In the United Kingdom, 15.35 percent of the monthly online spend comes from BNPL-payments. For more information about common payment methods in Europe, check out our overview of the most popular online payment methods in Europe.

Do you want to sell cross-border in Europe? It ain't easy but with the right ecommerce software, online marketing channels and European fulfillment companies market leadership is surely possible.

The ecommerce market in Europe

Research from 2023 shows that fashion is the most popular product category online. At leats 68 percent of the products that are purchased online in Europe, were either clothes, shoes or accessories. Physical multimedia such as books, DVDs or music follows second, with 34 percent.

Ecommerce sales in Europe were worth 899 billion euros in 2022. It is expected that online sales in Europe will reach 1.4 trillion euros by 2027. Most of the online turnover is still being generated in Western Europe, which accounts for approximately 70 percent of total European online retail turnover. Southern Europe, Northern Europe, Central Europe and Eastern Europe show a much lower share of European ecommerce with 15, 7, 6, and 1 percent respectively.

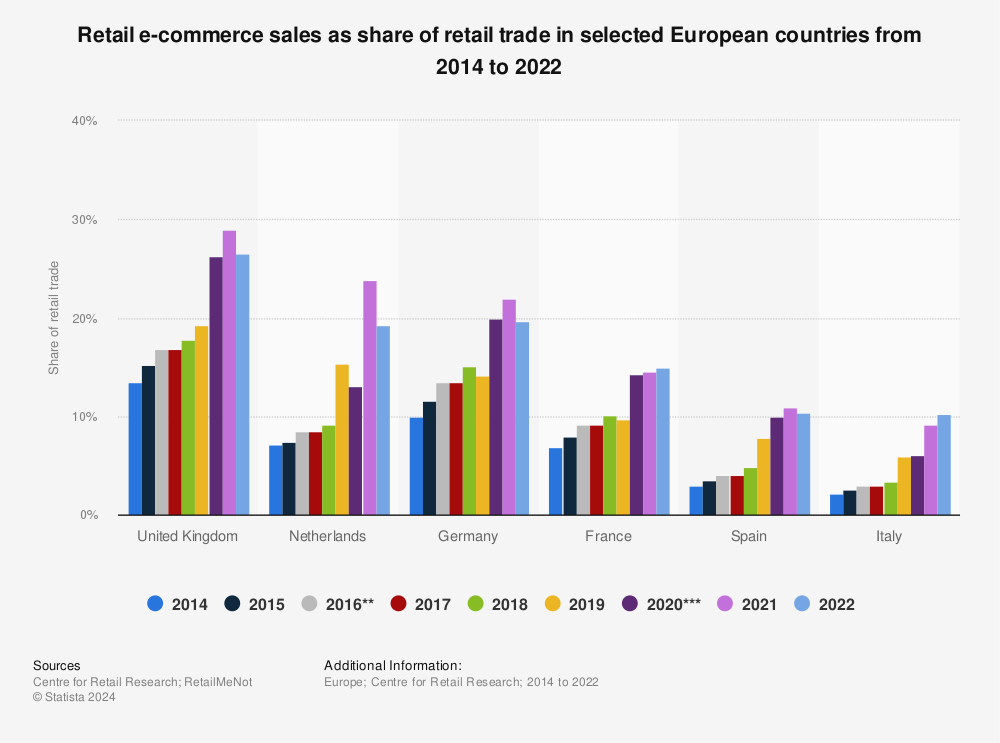

According to research by Direct Link, Germany and the UK are the strongest ecommerce markets in Europe. They have relatively high purchase amounts and a high ecommerce share combined with a large population. Data from Statista shows that ecommerce sales in the United Kingdom reached 25 percent of the total retail sale in 2022. In Germany, online sales amounted to 19 percent of the total retail trade. It is followed by the Netherlands, where online sales amounted to 18 percent of total retail trade, and France (15 percent).

Big online stores in Europe

Of course, major American retailers have their influence on local ecommerce industries in Europe. Online sales in Europe are driven by marketplaces. As a matter of fact, Amazon and eBay account for nearly half of the marketplace-driven trade in Europe, with a combined GMV of 55 billion euros and 23.2 billion euros in 2022. A ranking from the German Bundesverband Onlinehandel (BVOH) shows the top 10 marketplaces in Europe:

| 1 | Amazon.de |

| 2 | Amazon.co.uk |

| 3 | Ebay.co.uk |

| 4 | Allegro.pl |

| 5 | Amazon.it |

| 6 | Amazon.fr |

| 7 | Sahibinden.com |

| 8 | Ebay-kleinanzeigen.de |

| 9 | Ebay.de |

| 10 | Amazon.es |

However, when you zoom in on the ecommerce market in each European country, there will be differences in the biggest online stores. In 2024, Amazon is dominating the German ecommerce market, for example. While in the Netherlands, local online marketplace Bol is still the dominant retailer. There are a lot of lists of top 10 online stores on our website, such as this one: top 10 online stores in Europe, which features Amazon (on 7th place) as the only non-European player in that list.

Latest news about Europe

Read all our articles about ecommerce in Europe.